Published: Sustainability adaptation in Swedish banks

As a researcher in @Mistra BIOPATH Dr Ylva Baeckström works on “Integration of Biodiversity considerations into Financial Decision-making”. Here she gives a brief overview of Sustainability Adaptation in Swedish Banks, co-authored with Yanqing Wang and Torbjörn Jacobsson, published in the European Journal of Finance.

What is the purpose of the paper?

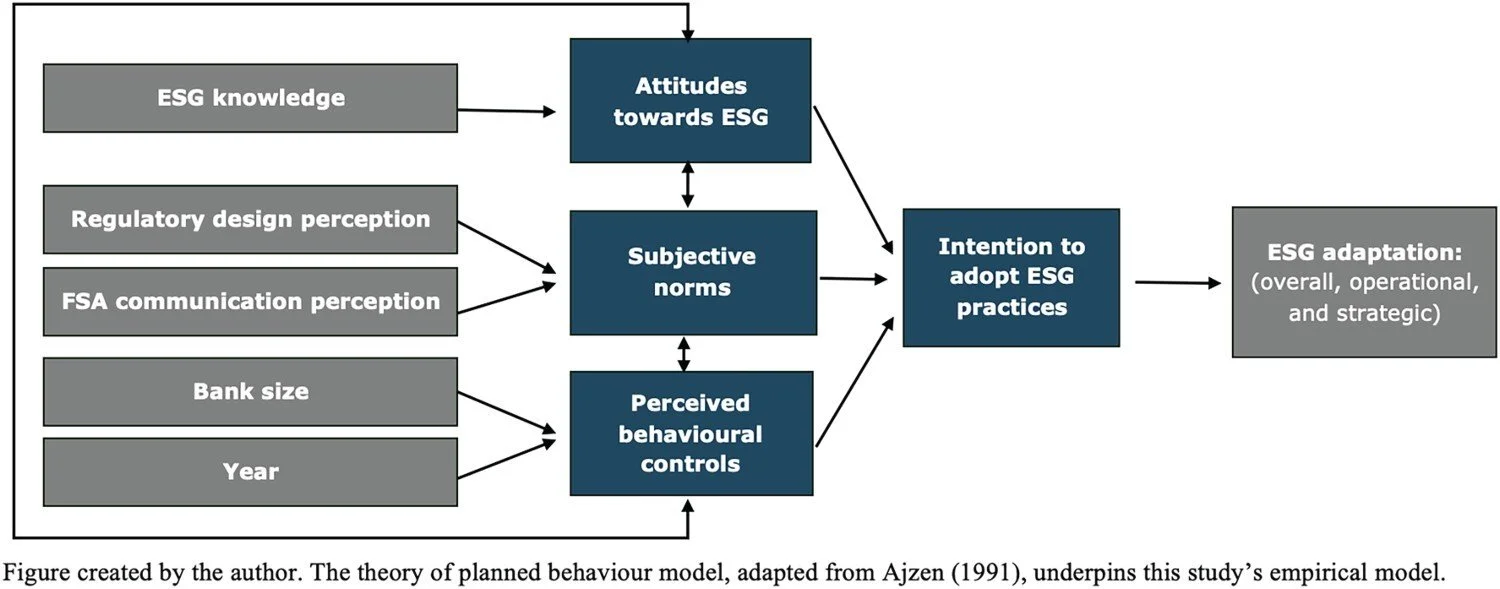

Our objective was to analyse how banks adapt to ESG integration as a maturing regulatory and strategic agenda. Drawing on the theory of planned behaviour we explore sustainability adaptation using survey data from senior bank leaders in over 100 Swedish banks between 2020 and 2023. Our results demonstrate that sustainability knowledge is key to enhancing senior leaders’ attitudes towards regulatory compliance and underpinning both strategic and operational ESG adaptation. How regulations are designed and communicated are also important.

How does it contribute to halting and reversing biodiversity loss?

The contribution to halting or reversing biodiversity loss is indirect but important. Financial regulators and policy makers need to pay attention to how they communicate with financial decision makers, ensuring leaders have sufficient knowledge to make sustainable decisions for their banks. The complexities around measuring biodiversity impact underscore the importance of knowledge sharing.

What can financial decision-makers learn from your findings?

We investigated how ESG literacy, firm size, and perceptions of regulatory design and communication shape operational and strategic ESG adaptation. Larger bank size supports strategic adaptation, with leaders stressing the importance of regulatory communication to ensure operational adaptation and viewing well-designed regulation as instrumental to strategic adaptation. With broad relevance to European Union (EU) banking sectors sharing similar cultural contexts and ESG regulatory frameworks, our findings offer valuable insights for regulatory bodies and practitioners.

How can the findings push the transition from knowledge to action?

Well-designed regulation and larger organisational scale support long-term ESG strategy, while strong regulatory communication drives short- to medium-term operational adjustments. ESG literacy facilitate all types of adoption.

What are the policy implications of the paper?

Our research highlights the importance of sustainability-focused training and communication to promote ethical behaviour and secure successful long-term sustainability adaptation. This is particularly valuable as EU regulators evaluate the Sustainable Finance Disclosure Regulation.

Link to the publication

Wang, Y., Baeckström, Y., & Jacobsson, T. (2025). Sustainability adaptation in Swedish banks: evidence from senior bank leaders. The European Journal of Finance, 1–23. https://doi.org/10.1080/1351847X.2025.2508515